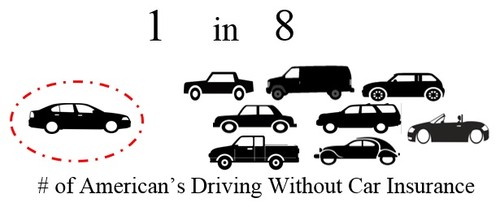

In Arkansas, as well as several other states, the insured party seeking the benefits of their uninsured motorist insurance has the burden of proving that the other vehicle is uninsured. As you might well imagine though, this can be a difficult obstacle to cross. An uninsured motorist will not always be eager to give up their information to you after an accident. Court’s understand this difficulty and there have been many different solutions offered to make the burden of proof fair to the insured motorist victim. When push comes to shove though, the initial burden still falls upon you to gather enough evidence to at least make a case that it appears the other driver was uninsured. For many, the insurance policy will state within the agreement what is or is not an uninsured vehicle. There was an uninsured motorist coverage claim that went to the Arkansas Supreme Court. In that case, a letter from the at-fault driver’s insurer stating that they disclaimed coverage was enough to meet the initial burden of proof. Even if you are unable to get that, there are several things you can do that will make gathering evidence easier.

Some things you can do are:

(1) take pictures of the scene of the accident

(2) get as much information about the at-fault driver, their car, and any passengers riding with them

(3) if possible, see if there are any witnesses who have helpful information.

At Oliver Law Firm we have years of experience litigating complex cases and representing clients who have suffered from personal injuries. If you have been involved in a wreck with an uninsured and/or underinsured driver we can help you get the payments you deserve. Our office is located just West of Exit 81 off I-49 in Rogers, Arkansas. Give us a call at 479-202-5200

We serve Rogers, Bentonville, Springdale, Lowell, Bella Vista, Centerton, Decatur, Highfill, Cave Springs, Gravette, Pea Ridge, Fayetteville, Huntsville, Berryville, Eureka Springs and all of Arkansas.

Oliver Law Firm, 3606 W. Southern Hills Blvd., Ste. 200, Rogers, AR 72758

We’ll Take the Reins.

a Free Consultation