If you’ve been watching TV lately, you may have seen a commercial from one of the big auto insurance companies describing their offers for rebates and credits. During the last week, it’s not just one insurer but most of the insurers doing the same. Wow, rebates and credits awarded by insurance companies to consumers! What a great PR move! But, is there more to this story? While this is great news, this is not the entire story.

Consider that during social distancing, more people are staying off the road. Compared to miles driven prior to the Pandemic, only about 50% or less miles are being driven after the orders to stay home. With fewer cars on the road, there’s a staggering drop in auto collision claims. In an average month, an insurance company pays out about $1B in claims. With fewer drivers on the road and fewer crashes, auto insurance claims are predicted to be down by about 85%.

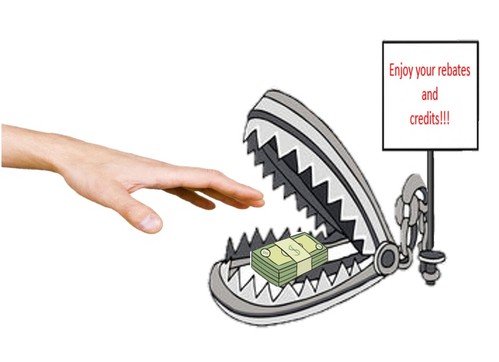

So, here’s the rest of the story. The big auto insurance companies are offering 15-20% back to consumers in the form of a credit that will apply to the consumers next full premium payment. The money going back to consumers is just a fraction of the amount insurers will be saving. If claims are expected to drop by 85%, and consumers are receiving 15-20% back, that’s just a drop in the bucket compared to the savings realized by the insurance companies. Do the math; 85% X $1B = a huge savings for the insurance company!

Could it be that the 15-20% rebates and credits are a PR move by the insurance companies and not about making things right for their own customers?

a Free Consultation